Leahy Life Planning

The Roadmap to the Future

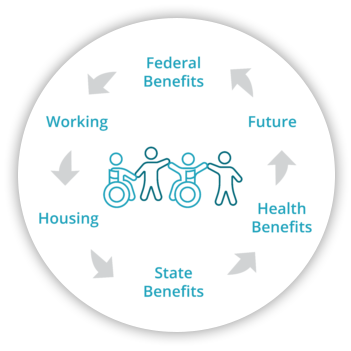

What is Disability Life Planning?

Leahy Life Planning Services

Federal Benefits

- Review past and current disability documentation

- Review individual’s assets and resources

- Describe Supplemental Security Income (SSI) / Medicaid & Social Security Disability Insurance (SSDI) / Medicare

- Assess federal benefits (SSI/SSDI/Medicaid/Medicare) eligibility

- Consult and guide regarding required and supplemental documents needed for various federal benefit programs eligibility

- Prepare individual and caregiver for federal benefits interview

- Provide understanding on the different levels of benefits and their maximum values

- Working and receiving SSA benefits

State Benefits

- Explain what Waivers are, and the different Waiver options available

- Review the applicability of state benefits and Medicaid eligibility

- Explain how to be eligible for Waivers through Medicaid

- Guide you through the process of obtaining Waivers

- Assessing and advocacy services regarding Individualized Support Plan (ISP)

- Assistance with Medicaid spend-downs

- Discuss housing options

- Implement Person-Centered Planning into ISP goals

- Maintaining employment while utilizing waivers

Financial & Community Planning

- Encompasses Waiver and SSA Packages

- Discuss strategies on long term future planning

- Help you understand the purpose of Special Needs Trusts and ABLE accounts

- Review strategies on best ways to fund a Special Needs Trust

- Assess individual’s current and potential assets

- Discuss differences and intertwining of federal, county and state-based benefits

- Explain Power of Attorney vs. Guardianship

- Give meaningful referrals to other services/agencies/professionals

- Preparation for Person-Centered Planning and Microboarding

Complimentary Webinars

- SSI/SSDI Eligibility

- Power of Attorney vs. Guardianship

- Working and benefits (Medical Assistance, Waivers, Federal Cash) eligibility

- Special Needs Trusts and Guaranteed Funding Streams

- Blending state and federal funding programs

- Medicaid and Medicare differences

- Planning for different life phases

- Understanding the ABLE Act

Business to Business

Individuals with disabilities have a great deal to offer to the workplace, but many employers are overwhelmed by the various factors that surround hiring an individual with disabilities. What is and is not within the bounds of reasonable accommodations? How can the employer ensure that disabled individuals are supported by those around them? While working with families of disabled children looking to join the workforce, Michele Leahy saw the need to help employers better serve their employees with disabilities.

As a result, Leahy Life Plan is now offering a wide array of disability planning services to employers, including support to accommodate and retain employees with disabilities, sensitivity training, review and editing of HR policies, and navigating the workplace and government benefits. In addition, we will work with employees with a disability and caregivers to bridge the divide between employer and employee. It is important for employees to understand the impacts that work can have on their lives, for example how employer sponsor benefits like a 401k and pensions can impact government benefits. Leahy Life Plan blends and braids support and services to best serve the workplace.

Help for the Sibling Caregiver

Falling Off the Disability Cliff

You’ve dedicated hours of your life to evaluations, therapy sessions, and IEP meetings to help your loved one with a disability succeed. The school services are coming to an end, and you will no longer be writing IEP mission statements at the beginning of every school year. What do you want life to look like for your loved one with a disability in 10 or 20 years? What about after you’re gone? What government services and programs are available to your loved one with a disability, and how can you connect them to both your goals as a family as well as the goals of your loved one with a disability?

Do you know what benefits your person with a disability is entitled to versus what they are eligible for? Do you know the difference between SSI, SSDI, Medicaid, and Medicare? Have you started planning financially for how your loved one will live when you can longer provide for them financially? Is it possible to find your loved one work without compromising their much needed government benefits?